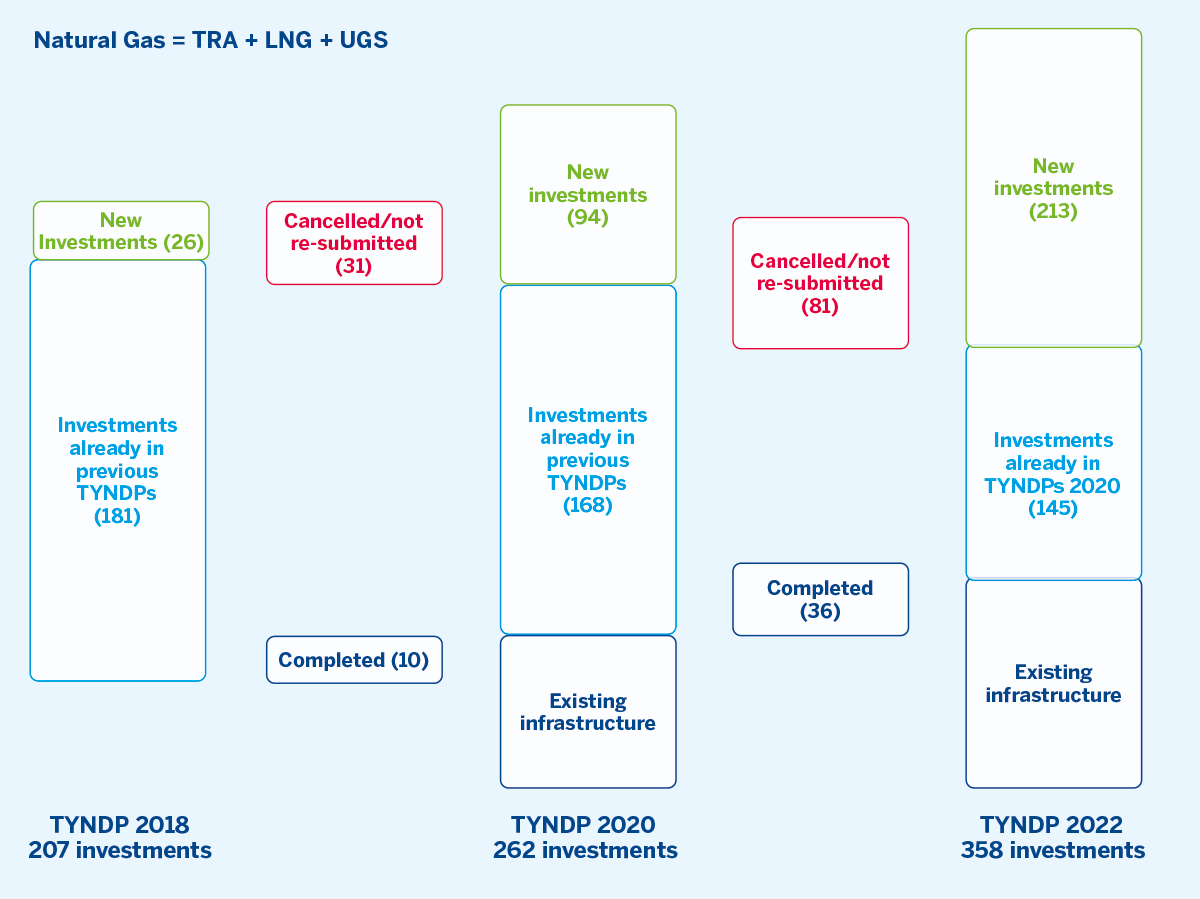

Overall, 358 investments have been included to TYNDP 2022 by more than 60 different project promoters including both TSOs and third-party promoters. The below graph provides the overview for this submission, compared to the previous TYNDP editions.

The full details of the project information included in the TYNDP 2022 can be found in Annex A of this Report. This section of the report provides a general information of the received submissions. Submissions are further analysed in Chapter 6 and 7.

Figure 4: Comparison between TYNDP 2018, TYNDP 2020 and TYNDP 2022

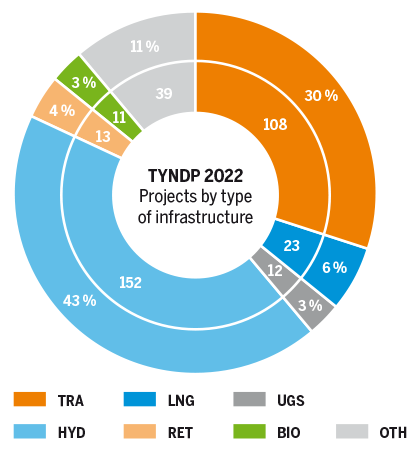

5.1 Type of infrastructures

For the previous TYDNP edition ENTSOG introduced for the first time a new project infrastructure category for Energy Transition Projects. TYNDP 2020 already included 75 Energy Transitions Projects.

Following the EU Green Deal and the revision process of the TEN-E regulation, ENTSOG decided to further evolve this category by replacing it with four new categories allowing more insights and reflection of development trends. Projects are classified in TYNDP 2022 according to the following infrastructure categories.

Projects are classified in TYNDP 2022 according to the following infrastructure categories:

- Gas Transmission pipeline including Compressor Stations (TRA)

- Reception and storage and regasification or decompression facilities

for liquified naturals gas or compressed natural gas (LNG) - Underground storage facility (UGS)

- New or repurposed infrastructure to carry hydrogen (HYD)

- Projects for retrofitting infrastructure to further integrate hydrogen (RET)

- Biomethane development projects (BIO)

- Other infrastructure related projects (OTH)

Renewable and low-carbon hydrogen will be key to decarbonise the hard-to-abate sector in the next years but alternatively some European countries can still reduce their carbon footprint by replacing more carbon intensive fuels. Investments falling under the TRA, UGS and LNG infrastructure category thus need to be technically suitable to transport, store or receive safely, securely, and efficiently increasing percentages of H2 (possibly up to 100 %) or contribute to the fuel-gas-switch within a country/area.

Figure 5 provides an overview of the submitted investment per Type of Infrastructure.

5.2 Projects commissioned since TYNDP 2020

The following map shows all projects that, from the last TYNDP edition, have been completed.

Figure 6: Map of projects commissioned since 2020

32 investments already part of TYNDP 2020 were completed over the years between both TYNDP editions. The commissioning of all these investments further contributes to the development of the European gas system, enhancing the level of market integration, security of supply and competition. Four of these projects are contributing to the energy transition.

Some of the above projects have been submitted to TYNDP 2022 but have been commissioned in the following months directly after the end of the project submission phase (commissioning date < 31.12.2022) and will be therefore considered in the TYNDP 2022 Existing infrastructure level and is no longer part of the promoter submission analyses in the next chapters.

5.3 Projects foreseen to be commissioned soon

| Project code | Project name | Promoter | Country | Comissioning year |

|---|---|---|---|---|

| TRA-F-342 | Enhancement of Latvia – Lithuania interconnection (Lithuanian part) | AB Amber Grid | LT | 2023 |

| TRA-F-382 | Enhancement of Latvia – Lithuania interconnection (Latvian part) | Conexus Baltic Grid, JSC | LV | 2023 |

| TRA-A-1199 | LNG Terminal Brunsbüttel – Grid Integration | Gasunie Deutschland Transport Service GmbH | DE | 2023 |

| TRA-F-814 | Upgrade for IP Deutschneudorf et al. for More Capacity | ONTRAS Gastransport GmbH | DE | 2023 |

| LNG-A-62 | LNG terminal in northern Greece / Alexandroupolis – LNG Section | Gastrade S.A. | GR | 2023 |

| TRA-A-63 | LNG terminal in northern Greece / Alexandroupolis – Pipeline Section | Gastrade S.A. | GR | 2023 |

| TRA-A-988 | LNG Terminal Stade – Grid Integration | Gasunie Deutschland Transport Service GmbH | DE | 2023 |

| TRA-F-539 | FSRU 1 Connection | Snam Rete Gas S.p.A. | IT | 2023 |

| LNG-F-1134 | FSRU 1 – SNAM | Snam Rete Gas S.p.A. | IT | 2023 |

| LNG-F-272 | Upgrade of LNG terminal in Świnoujście | GAZ-SYSTEM S.A. | PL | 2023 |

| TRA-F-329 | ZEELINK | Open Grid Europe GmbH and Thyssengas GmbH | DE | 2023 |

| TRA-F-362 | Development on the Romanian territory of the Southern Transmission Corridor | SNTGN Transgaz SA | RO | 2023 |

| TRA-F-755 | CS Rimpar | GRTgaz Deutschland GmbH and Open Grid Europe GmbH | DE | 2023 |

| TRA-A-1090 | Metering and Regulating Station at Alexandroupoli | DESFA S.A. | GR | 2023 |

| TRA-F-1115 | WAL | Open Grid Europe GmbH | DE | 2023 |

| TRA-F-1276 | Upgrade of Nea Mesimvria Compressor Station | DESFA S.A. | GR | 2023 |

| TRA-F-1278 | Compressor station at Ambelia | DESFA S.A. | GR | 2023 |

| OTH-A-430 | Porthos | Porthos Development CV | NL | 2023 |

| HYD-A-562 | Energy Park Bad Lauchstädt | ONTRAS Gastransport GmbH | DE | 2023 |

| TRA-A-809 | Reallocation H-Gas towards NL: Bunde/Oude to Zone Oude Statenzijl H | Gasunie Deutschland Transport Services GmbH | DE | 2023 |

| OTH-A-924 | Power to Methanol Antwerp | Power to Methanol Antwerp BV | BE | 2023 |

| TRA-A-1268 | Romania – Serbia Interconnection | SNTGN Tranzgaz SA | RO | 2023 |

| TRA-A-564 | FSRU in Le Havre connection | GRTgaz | FR | 2023 |

| LNG-A-1123 | Expansion of Revithoussa LNG Terminal via installation of FSU | DESFA S.A | GR | 2023 |

| LNG-F-178 | Musel LNG terminal | Enagas Transport S.A.U. | ES | 2023 |

| TRA-A-1275 | Zeebrugge Opwijk | Fluxys Belgium | BE | 2023 |

Table 1: Investments included in TYNDP 2022 whose expected commissioning year is 2023