Picture courtesy of the European Commission

1 A new TYNDP 2022 to support the European Green Deal

1.1 TYNDP 2022 scenarios:

Net-Zero 2050 and COP 21 compliant

TYNDP 2022 scenarios support the European energy and climate ambitions

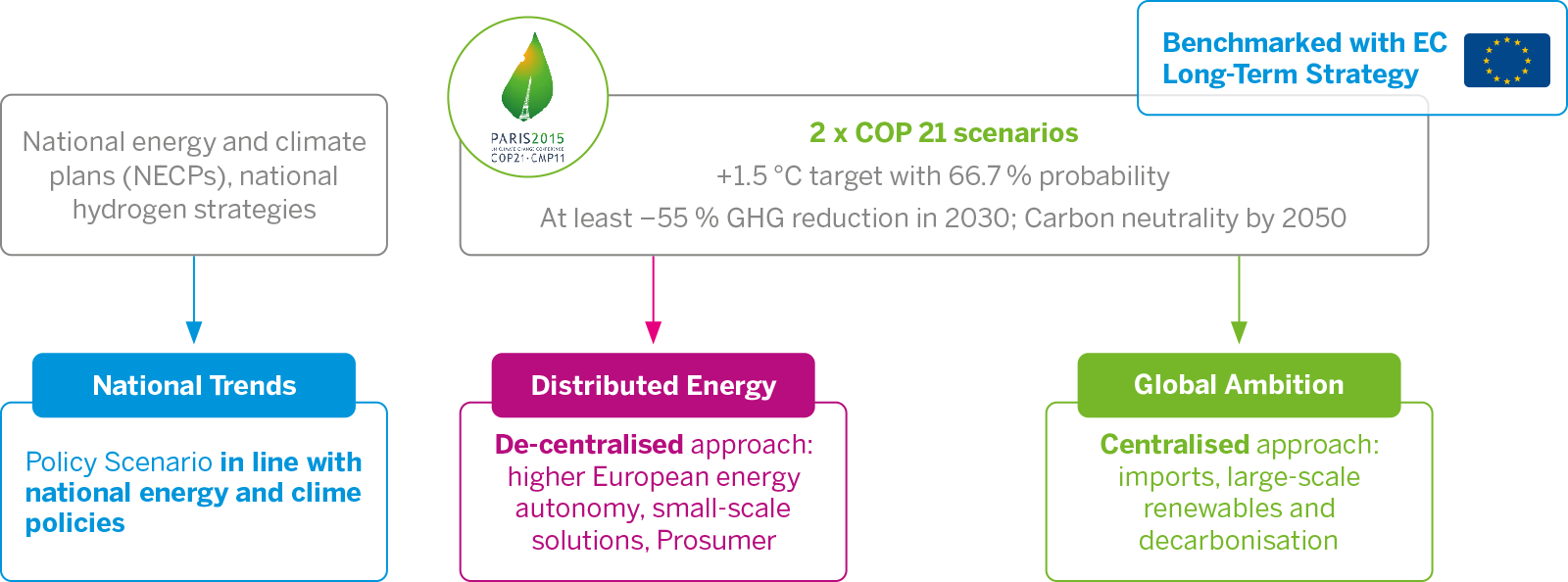

For the 2022 edition of their TYNDP, ENTSOG and ENTSO-E have developed sustainability-oriented scenarios reaching net-zero carbon emissions in 2050, considering either national policies as defined by the Member States’ National Energy and Climate Policies (2019 NECPs , national long-term strategies, hydrogen strategies, etc.) published in the last years or the objectives as defined in the Paris Agreement (COP 21). All scenarios therefore comply with European and national ambitions as displayed in Figure 2 and were consulted with stakeholders during the definitions of the scenarios’ storylines.

Furthermore, building on the ever-improving interlinked model developed jointly by ENTSO-E and ENTSOG, the COP 21 scenarios – Distributed Energy and Global Ambition – are built on a holistic approach to the European energy system considering the total primary energy mix of Europe to ensure consistency across all sectors, beyond considering the sole interactions between gas and electricity. It is also the first time that the scenarios have modelled hydrogen and electrolysis at pan-European scale.

Figure 2: TYNDP 2022: scenario storylines

1.2 The gas system is a key asset

to reach net-zero 2050

An evolution of the energy infrastructure is necessary to allow significant import and production capacities of renewable and decarbonised gas, and to provide for the demand for new gases like hydrogen and biomethane.

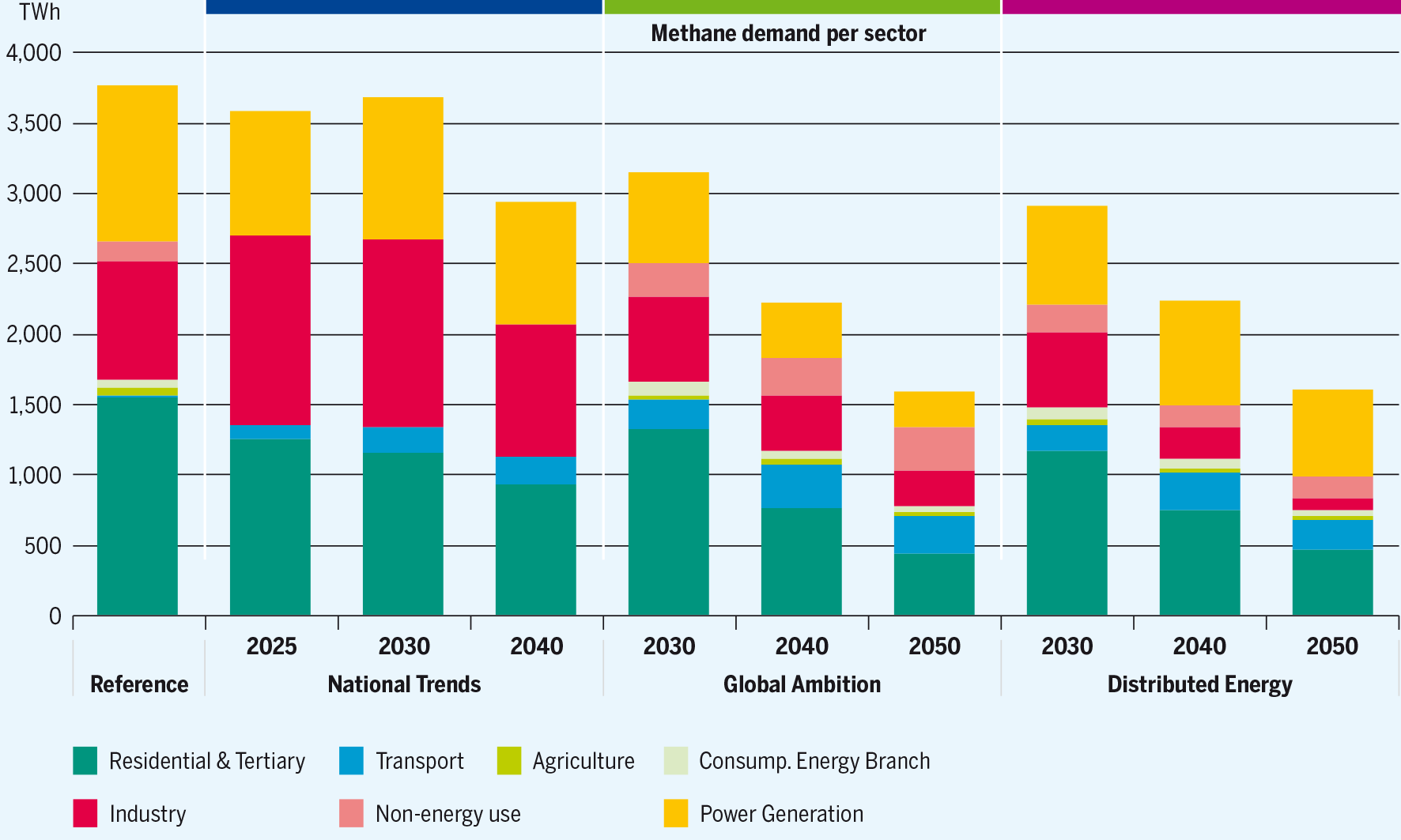

Natural gas demand decreases and its supply decarbonises over time with biomethane

Aggregated on EU level, national policies show a large role for natural gas as a gas energy carrier with very limited evolution of the demand until 2030. After 2030 however, the natural gas demand decreases with the implementation of the strategy of some Member States which at the same time see the uptake of renewable gases and hydrogen demand.

The development of the final natural gas demand differs from region to region. Due to a high dependence on coal and coal-to-methane switch policies, methane demand for heating rather increases in Central and Eastern Europe, whereas other regions head towards more electrification in the private heating sector.

Following the evolution of the hydrogen and methane production capacities, the methane demand decreases as renewable gases and hydrogen develop already at 2030. In all scenarios the natural gas consumption needs to be abated by 2050, either by direct replacement with non-emitting gases or by combination with CC(U)S. The demand for methane is generally sustained by the final demand including non-energy use and the indirect demand of abated natural gas for hydrogen production.

Figure 3: Methane (natural gas, synthetic methane and biomethane) demand per sector for EU27 (before REPowerEU update for Global Ambition and Distributed Energy for 2030)

Hydrogen as a key element to reach carbon neutrality

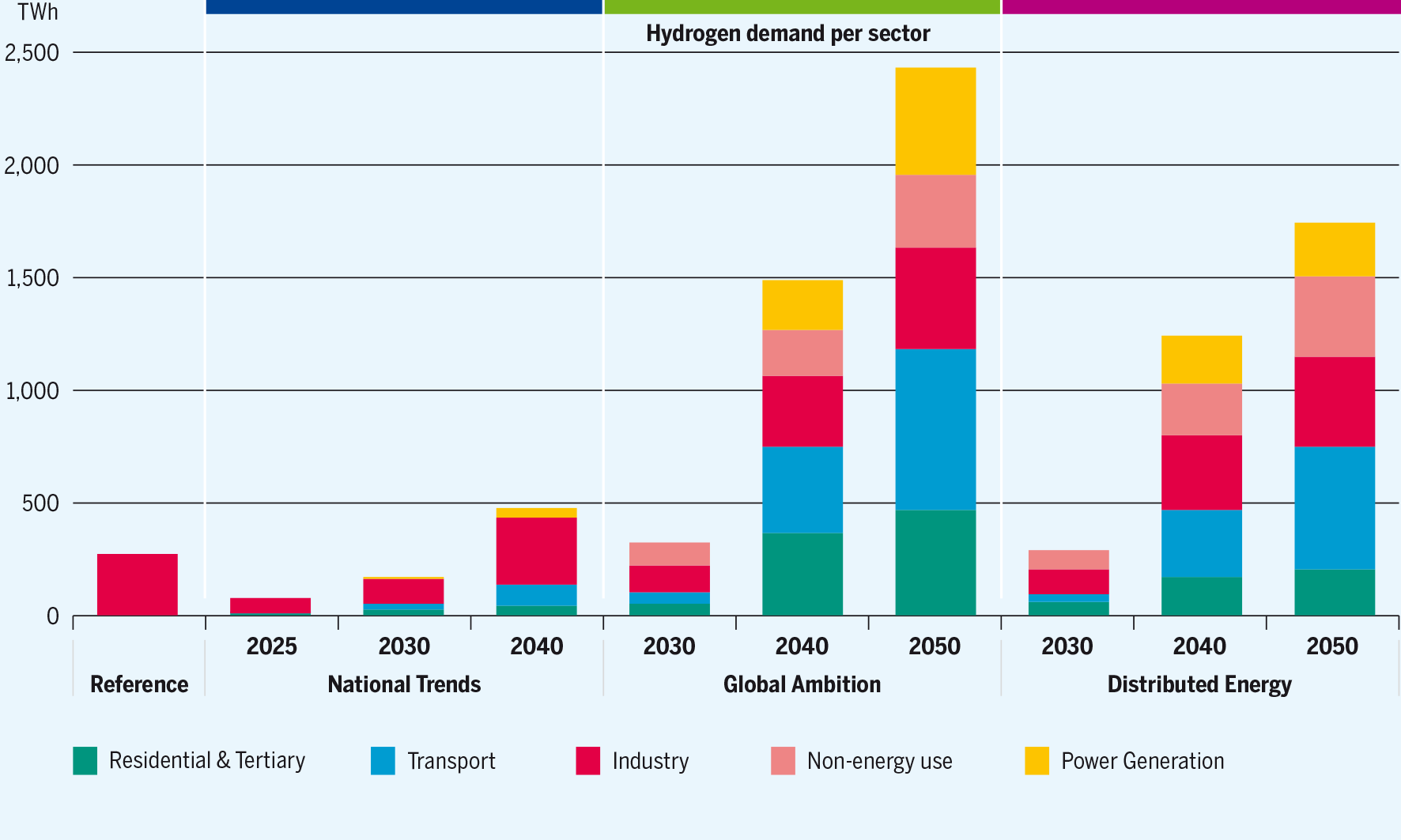

In all scenarios, the demand for hydrogen develops as of 2030 and hydrogen becomes the main gas energy carrier in both COP 21 scenarios in 2050. Today, hydrogen is mainly used as a feedstock for the industry. However, as the demand for clean gaseous energy increases to meet the COP 21 and EU climate and energy targets, hydrogen is mainly used for its energy content and as energy carrier by 2040 and its use as feedstock becomes less dominant over time.

The National Trends scenario considers the different national policies of the EU Member States that are currently under revision. Whereas some countries plan for the development of hydrogen to replace natural gas with objectives defined for 2030, some other countries plan for a more stepwise approach to move away from the most carbon intensive fuels, especially in the coal mining regions. Therefore, at EU level, this translates into a slower development of the hydrogen demand which is nevertheless steadily accelerating between 2025 and 2040 at EU level.

Most of the current (modelled for 2025) hydrogen produced locally (as feedstock mostly) in the industrial clusters is not included in the figures since they are not connected to any regional or national networks and currently produce their hydrogen from methane. This relates to hydrogen production mainly from methane through steam methane reforming (SMR) or autothermal reforming (ATR).

Both COP 21 scenarios require significant amounts of hydrogen to meet the COP 21 and EU climate and energy targets and reach carbon neutrality by 2050. Hydrogen can be produced indigenously in the EU to a significant extent, as well as be imported from some extra-EU countries, that have significant potentials to produce renewable, cost-competitive hydrogen and can be actors of a global clean hydrogen market. In addition, as identified in the Scenario Report, hydrogen production from methane through steam methane reforming (SMR) or autothermal reforming (ATR) in combination with carbon capture and storage (CCS) can support the development of the hydrogen demand by securing the supply and thereby accelerate the decarbonisation of the European economy. Furthermore, if biomethane is used instead of natural gas, those decarbonisation solutions can become carbon negative and help to recover from the carbon budget overshoot after 2050.

This is a key factor underpinning the investments into all hydrogen and biomethane infrastructure to be ready and start contributing to COP21 targets as soon as possible, even before 2030.

Gases (methane and hydrogen) are part of the solution towards net-zero 2050

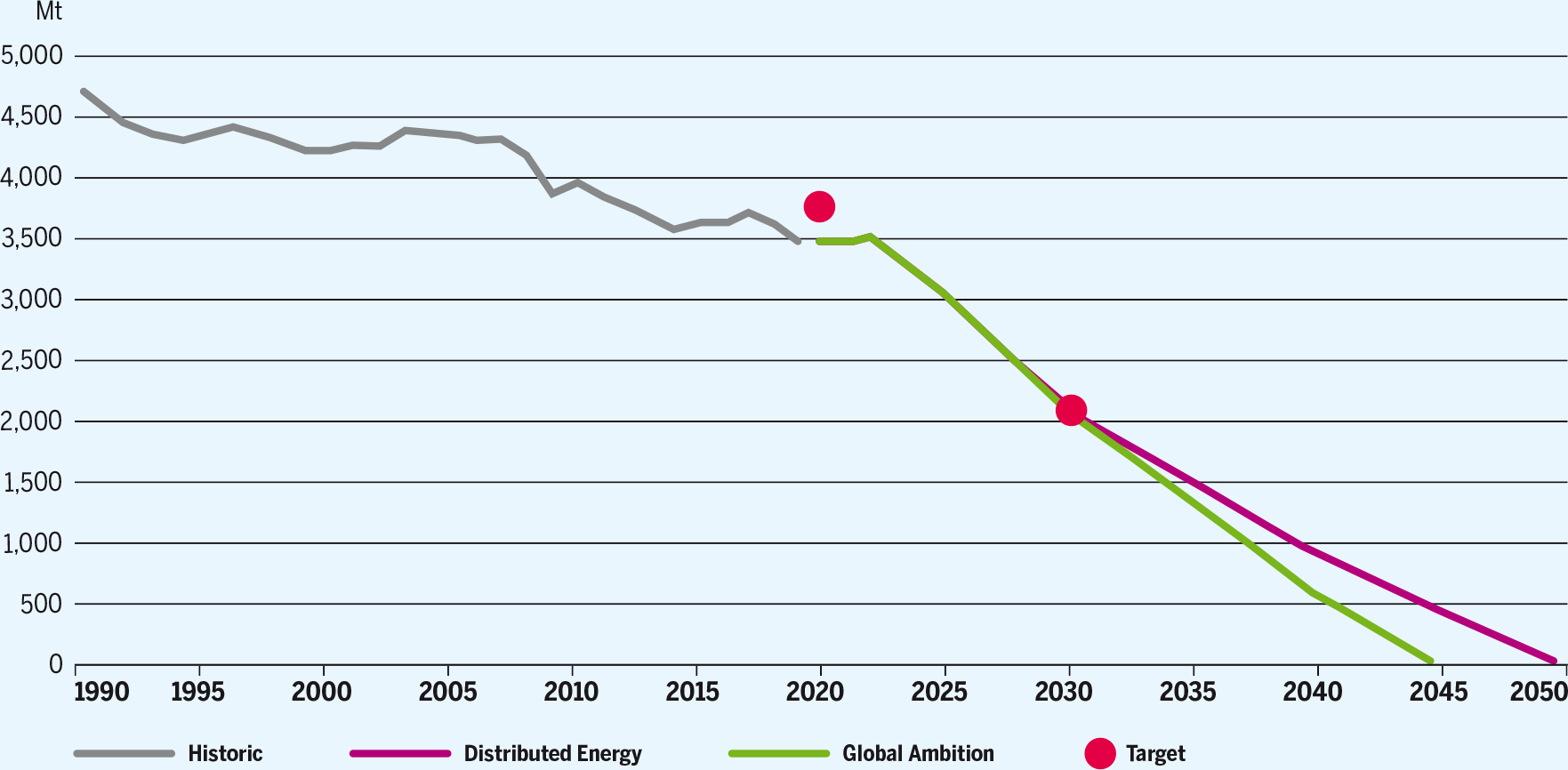

TYNDP scenarios confirm the need for various renewable and decarbonisation technologies and the interdependence of the gas and electricity systems in reaching a net-zero European energy system by 2050.

Figure 4: GHG emissions in Distributed Energy and Global Ambition (before REPowerEU adjustments for 2030)

TYNDP 2022 scenarios confirm that power-to-gas is a key technology to integrate electricity from variable renewables to a larger scale. It optimises the usage of fluctuating renewable energy production, allows for seasonal energy storage that otherwise could only be offered by hydro storages, and opens affordable long-distance transport options. Since the electricification of the heat market drives up the winter demand for electricity, flexible methane- and hydrogen-fired power plants play an increasingly crucial role, translating into flexibility needs of the gas systems.

The most extreme climatic stress cases are therefore covered by the System Assessment.

Underlining the goal of European energy independence, the COP 21 scenarios show lower total energy import needs than the EU Impact Assessment scenarios.

Figure 5: Hydrogen demand per sector for EU27 (before REPowerEU update for Global Ambition and Distributed Energy in 2030)

1.3 Adjustment of the TYNDP 2022 to REPowerEU

The invasion of Ukraine by Russia on 24 February 2022 has led to a major overhaul of energy policy objectives in terms of energy security and diversification of supply.

The REPowerEU Plan, published by the European Commission, is Europe’s collective response to the global energy market disruptions caused by Russia’s invasion of Ukraine. It is a plan for reducing energy consumption, accelerating the production of clean energy and diversifying energy supplies to reduce Europe’s dependency on Russian natural gas. The REPowerEU Plan sets out a series of measures to accelerate the energy transition, while increasing the resilience of the EU-wide energy system. The plan includes measures for increased production of biomethane, targeted investments in gas infrastructure as well as proposals for LNG and hydrogen purchases from alternative supply sources. The TYNDP 2022 development process was adjusted and modified to include these ambitions into the perspective of the infrastructure development and its assessment.

The TYNDP 2022 scenarios, published in April 2022, could not address and consider the requirements of the REPowerEU Plan that were published later. To include these ambitions into the perspective of the infrastructure development and its assessment, the TYNDP 2022 scenarios for 2030 were therefore adjusted by ENTSOG, in alignment with the EC. The aim was to keep the main findings of the published TYNDP 2022 Scenario Report, in particular those linked to the use of electricity, while considering the major changes regarding gas supply. Therefore, ENTSOG has amended the TYNDP COP 21 scenarios – Distributed Energy and Global Ambition – for the year 2030 according to the REPowerEU Plan and its objectives of 10 mt domestic green hydrogen production and 10 mt hydrogen import.

Data of the updated scenario will be made available on the TYNDP visualisation platform .

Hydrogen and Natural Gas TYNDP 2022 – how hydrogen and biomethane projects will drive the decarbonisation

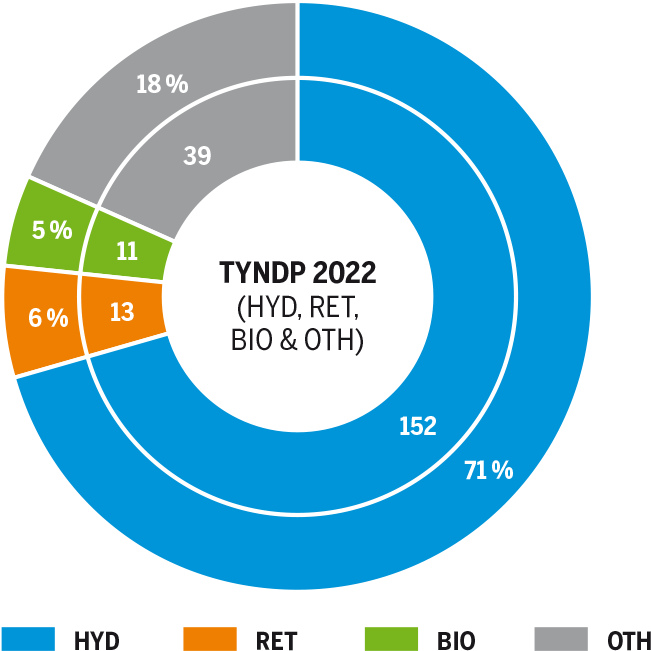

Already for the previous edition (TYNDP 2020), ENTSOG introduced a new project infrastructure category for Energy Transition Projects. The TYNDP 2020 included 75 Energy Transition Projects. Following the EU Green Deal and the revision process of the TEN-E Regulation, ENTSOG decided to further evolve this single project category in four different new categories, better allowing for sector-specific insights and displaying development trends.

The TYNDP 2022 includes 215 investments relevant for these four new categories, concerning 26 countries. The new categories are:

- New or repurposed infrastructure to carry hydrogen (HYD)

- Projects for retrofitting infrastructure to further integrate hydrogen (RET)

- Biomethane development projects (BIO)

- Other infrastructure-related projects (OTH)

Overall, 358 investments are covered by the TYNDP 2022 out of which 143 are natural gas projects. They were submitted by more than 60 different project promoters including both Transmission System Operators (TSOs) and third-party promoters. The collection was facilitated by ENTSOG’s decision to to re-open the project collection process with the purpose of including relevant projects in the light of security of supply after the Russian invasion of Ukraine, in line with European Commission REPowerEU targets.

The extensive data collection carried out for TYNDP 2022, allowed for the consideration of hydrogen infrastructure levels as a first step on the assessment and analysis of hydrogen infrastructure.

Among these new infrastructure categories detailed above, hydrogen infrastructure projects were collected as part of the dedicated new hydrogen project category.

Moreover, hydrogen infrastructure projects were divided into different subcategories of hydrogen infrastructure, such as:

- On-shore or off-shore hydrogen transmission pipelines (newly constructed or repurposed from natural gas pipelines) including pipelines enabling hydrogen imports from extra-EU countries.

- Newly constructed or repurposed liquefied hydrogen terminals including hydrogen embedded in other chemical substances with the objective of injecting the hydrogen into the grid.

- Hydrogen storages (newly constructed or repurposed from natural gas infrastructure).

Hydrogen infrastructure levels

For the first time, in TYNDP 2022 edition, ENTSOG has introduced hydrogen infrastructure levels. These include not only hydrogen infrastructure projects submitted in December 2021 and June 2022 to the TYNDP 2022, but also those additional hydrogen infrastructure projects that were candidated by December 2022 to the first PCI selection process under the revised TEN-E Regulation.

Hydrogen infrastructure is at an early stage of development compared to natural gas infrastructure. Unlike natural gas, hydrogen infrastructure levels can only be defined with the consideration of planned projects, as there is no existing infrastructure in place. In comparison with the natural gas infrastructure levels, the hydrogen infrastructure levels are not based on project status that reflect their maturity. For comparison, natural gas infrastructure reaches already for the existing infrastructure level a considerable level of maturity for most European countries, since it has been gradually developed over the years.

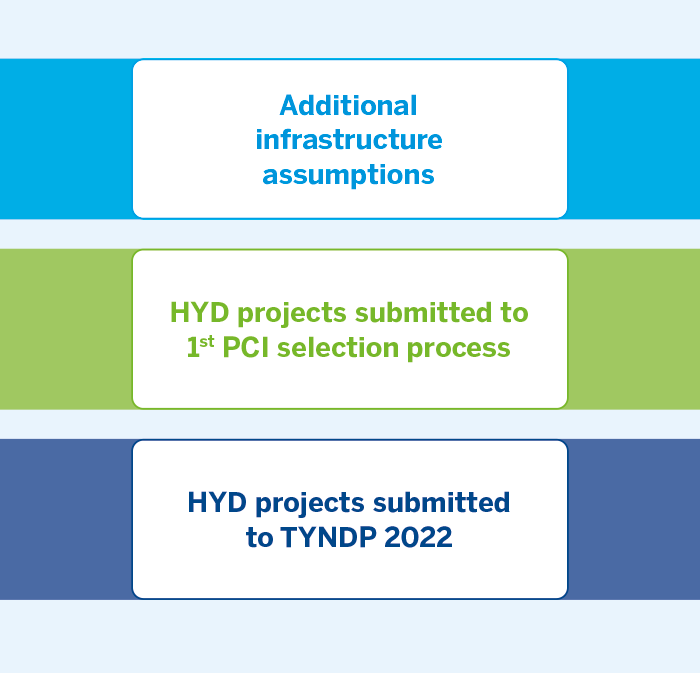

In the TYNDP 2022, two hydrogen infrastructure levels were included:

- Hydrogen infrastructure level 1:

Hydrogen Infrastructure level 1 is a project-based infrastructure level, composed of all hydrogen projects submitted by project promoters to the TYNDP 2022 (including infrastructure that was submitted as hydrogen-ready1) as well as hydrogen projects submitted by project promoters to the first PCI selection process under the revised TEN-E Regulation.

- Hydrogen infrastructure level 2:

Hydrogen Infrastructure level 2 is defined as a policy-based infrastructure, composed of Hydrogen Infrastructure level 1 and additional infrastructure assumptions that were developed by ENTSOG together with the TSOs to enable policy objectives, such as the 2030 hydrogen imports targets defined by the REPowerEU Plan.

Figure 7: Hydrogen infrastructure levels in TYNDP 20222

1 Hydrogen projects that apply for the PCI status will undergo a thorough eligibility check by the European Commission. Since this eligibility check was not completed during the preparation of this document, no project that fulfilled the formal submission criteria to the TYNDP 2022 was rejected by ENTSOG. The inclusion of a project in the TYNDP is neither an endorsement by ENTSOG nor by an EU body.

2 PCI candidates projects can be found in the Hydrogen map

1.4 ENTSOG TYNDP: National expertise at the service of the European energy and climate ambitions

The TYNDP 2022 relies on expertise of the European gas and electricity TSOs. TSOs are at the interface of production operators, mid-stream, LNG, hydrogen terminal and storage operators, downstream consumers, and distribution systems.

They operate national networks and the largest cross-border energy infrastructure, backbone of the European energy market and are essential to the cooperation between Member States to ensure the security of the energy supply of the EU.

An inclusive and transparent TYNDP

Continuing a tradition of high transparency, all methodologies, input data, technical data and results are available for download on the ENTSOG website.

To further clarify the neutrality of ENTSO-E and ENTSOG in the TYNDP processes, the associations will further improve and reinforce stakeholder involvement in the next TYNDP editions, to ensure neutrality and transparency along the process.